HIGHER RETURN AND PEACE OF MIND

Hotelesque owners get a significantly higher return on their properties compared to other home hotel operators. And they get peace of mind with our award winning team managing it.

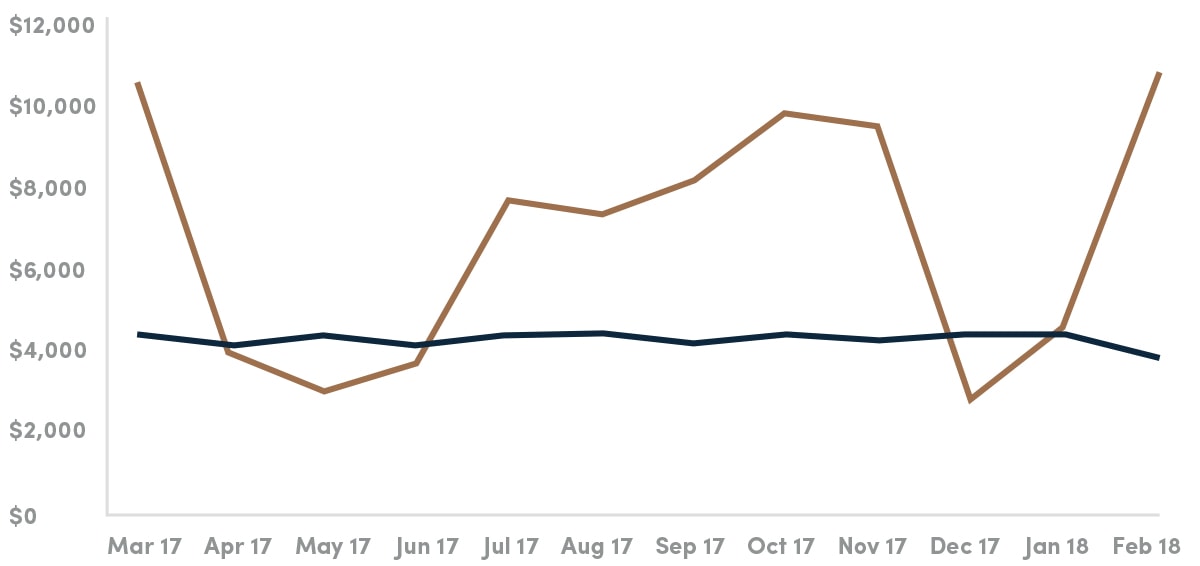

This case study is based on an apartment in Sydney’s Eastern suburbs, located on the coast and renovated less than 5 years ago. The property is located in an area with easy access to the beach and cafes, offering a village feel. The property is available almost all year round and forms part of an investment strategy which complements the owners other investment properties. There is no mortgage over this property. The owner engaged Hotelesque to furnish and fully equip the property with a budget of $25,000. The graph below shows the gross monthly comparison between an unfurnished estimated long term rental and the actual executive leasing return managed by Hotelesque.

Total Gross Rent paid Mar 2017 to Feb 2018: $92833.00

Total Guests over last 12 months: 11

Average nightly Rate: $300 per night

Average night stay per guest: 28

Annual occupancy: 87 %

Estimated total rent for 12 months $62571.43

Please note: These results reflect gross returns excluding management fees and other costs such as wifi, Foxtel, and utilities etc . Also this does not take into account the positive impact of depreciation or tax deductions. Always refer your accountant or financial planner to confirm a complete financial position.

Harriette

$92833.00

50 weeks

87%

3.75 %

As a busy professional living in Sydney, I only return home for a couple of weeks of the year for a coastal getaway, so this is mostly an investment for me. Knowing my home is being looked after by the best, making me the biggest return it can, enables me to maintain the property well whilst earning a great income. I loved that Hotelesque offered the full service and did all of the furnishings too.

Hotelesque owners get a significantly higher return on their properties compared to other home hotel operators. And they get peace of mind with our award winning team managing it.